We live right next to several gigantic mountains in Utah, and over the past couple of days, it’s been a relief to see the snow melting away; in fact,  today it’s supposed to reach almost 70 degrees! With baseball just beginning, our garden sprouting up, and new buds forming on our bonsai tree, it’s clear that spring has finally arrived.

today it’s supposed to reach almost 70 degrees! With baseball just beginning, our garden sprouting up, and new buds forming on our bonsai tree, it’s clear that spring has finally arrived.

Is anybody else starting to get the vacation bug?

Start Saving For Your Next Vacation Today

There’s nothing worse than having the summer months roll around and not having the funds to capitalize on a much needed vacation. As nice as it is to find a quiet park and just read a book, there’s something very appealing about jumping on a plane and having a vacation on a warm, sunny beach.

Alex and I save about $100 per month for vacations. It doesn’t sound like a lot, but when it finally comes time to take a vacation, we’ve got $1,200 to spend! For a couple of college students, we consider that plenty of money to play with.

We treat our “Vacation Fund” in our budget just like we do any other expense- it gets paid before the end of the month every time. Our “Christmas Fund” is the very same way. And if you approach your savings like you do your expenses, you’ll reap the rewards that good, disciplined savings yield.

Be Practical About The Types Of Vacations You Take

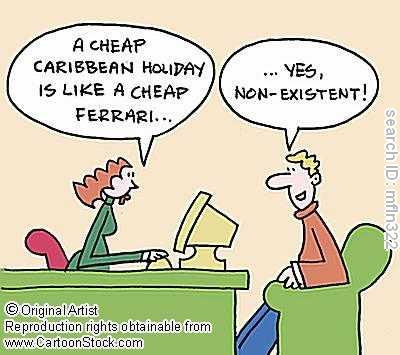

Not all of us can really afford “expensive” vacations, so take a practical approach to the money spend on your time off. Our family’s $100 per month is about 2% of our total monthly expenses and savings; in other words, the money we set aside for vacations is very minimal in comparison to what it costs us to live and save.

Though I don’t think there are any set guidelines on how much you should be spending on a vacation in comparison to your income, savings, debt, and expenses, I still believe you should consider how your vacation money stacks up to your entire financial situation. Before you set a monthly “Vacation Expense” in your budget, spend a few minutes looking at your financial position as a whole. How much debt do you have? Are you saving enough money each month to justify creating a “Vacation Fund” in your budget?

Again, I don’t think we’re all entitled to an expensive vacation “just because.” Let’s be practical.

Who Says Your Vacation Has To Be Expensive

The words “travel” and “expensive” don’t have to belong in the same sentence as “vacation.” I know it’s more fun to jump on a plane and fly somewhere exotic, but you don’t have to go to that extreme to have an enjoyable vacation.

Taking time away from the regular rigor of life is important- no question about it. You need time away. But that doesn’t mean it has to brake your bank. You could go hiking, backpacking, fishing, or camping. If you’re not the “outdoorsy” type, you might consider starting your vacation off by browsing your local library for a book you’ve been wanting to read. Find a park nearby and read (by the way- I can’t even imagine doing this, as the only types of books I ever read are textbooks). I love TV shows like 24, Prison Break, and The Office. Take a couple of days off and watch the seasons you’ve missed!

———————————————————

Save money now for next year’s vacations. As you’re evaluating your budget, set apart a practical amount of money for your new “Vacation Fund.” If your budget is already too tight, don’t decide to just NOT go on a vacation; do something locally and relatively inexpensive.

We’re living in a time where deadlines are never-ending. The therapy a vacation provides is essential.

Do you have a “Vacation Fund” in your budget? How much do you save each month for your vacations?